It has become an established truth that corporate acquisitions result in a deterioration of shareholder value . Frequently a cause given for this is lack of, or inadequately performed post merger integration efforts.

Any integration process must be adapted to the respective transaction. However, there are some dimensions that should always be considered in order to increase the likelihood of a value-creating acquisition.

Dedicated project management, clear leadership, in combination with a cohesive and comprehensive internal and external communications plan is important.

The planning of the integration process should nor be delayed until post closing, but should form part of the initial acquisition assessments to maximize the chances of a successful merger.

Acquisitions impair shareholder value

Measuring an acquisition’s success is not straightforward. For listed companies, analysis of share price movements before and after the announcement of the transaction is commonplace to assess how market participants evaluated the transaction. Such studies implicitly assume that market participants are able to value the transaction effects perfectly. For unlisted companies, there are further challenges in finding good appraisal parameters, since access to data is naturally more restricted.

Analysis of financial results over different time horizons are complicated because it is difficult to isolate studies exclude other effects than the transaction. It is also impossible with any degree of certainty to value what would have been the outcome if the acquisition had not taken place, or alternatively a competing company had undertaken it. That said, a magnitude of studies have been conducted with great variety in research methodology and with diverse data sets. The conclusions are almost in unison that the buyer pays in excess to the values achieved. The same research points to various explanations. Managerial hubris, but also asymmetric incentives between management and shareholders, can lead to a too high purchase price compared to the underlying intrinsic values.

Often cultural differences are highlighted as an inhibiting factor and often underestimated. Little or poor communication internally and externally is said to worsen the outcome of the acquisition. Poorly defined acquisition strategies can make it hard to materialize the values that the transaction was intended to create.

Missing or inadequate due diligence (DD) is pointed towards as a contributing factor. Due diligence processes are often carried out with restrictions on time and information accessibility. The aim of which is to arrive at a fair market value of the target company. Such valuations usually consist of some overall “top down” assumptions that can lack a foundation within the organizations.

Post Merger Integration (PMI) is frequently referred to as being underestimated during due diligence and later. In the following, we will focus on the Post Merger Integration (PMI) process, how to plan for it and some areas to particularly focus on.

Due dilligence

Focus during DD is to establish conditions for the acquisition, valuation and negotiations. Nevertheless, it is not advisable to leave it until after signing to consider how to achieve the transaction values. It is not the intention to prepare detailed implementation plans at this stage. Rather to visualize, in broad terms, how to proceed post-closing to reach the desired synergies. Such considerations should be reflected in the valuation, and in the determined transaction price. Figure 1 portrays an ideal transaction process flow.

At the time of signing, it is vital, as a minimum, to have in place an immediate internal and external communication to the market and employees. Beyond this one is, for various reasons, restrained from carrying out actual integration efforts at this stage. The competition authority’s permission is often necessary and during the period between signing and closing there usually are restrictions on interaction between the parties.

Merger preparations

The aim of PMI is to put the original acquisition strategy to life. The business plan that was developed during the acquisition maps out where added value is intended to be generated through cost, revenue or capital synergies. After signing, the acquirer gets access to an expanded number of information contributors, and is also now less exposed to “hard” deadlines. It is beneficial to use this time now to improve on the current business plan and build this “bottom up”. This would involve building an integration plan with a higher level of detail.

Exactly how this is to be effected depends on the individual case. There are however some dimensions that will always be relevant and we will discuss them in the following.

“The integration plan should continuously be monitored and adjusted along the way”

Deal strategy

Conventional combination/synergistic acquisitions focus on achieving synergies and minimizing the potential for adverse effects from the risk factors uncovered during due diligence. Synergistic acquisitions revolve around simplifying and improving business processes. It will often be crucial to deliver on targeted objectives quickly in order to succeed.

However, if the underlying deal strategy is to transform the existing business, it is critical not to let the existing acquisition business plan and DD reports become limiting factors in the developing the combination. Such mergers are often more time consuming. They are more dynamic and often require a broader involvement from both organizations.

Organization

One of the biggest challenges of PMI is that in parallel, the organization’s day-to-day activities need to be monitored and managed effectively. We have seen companies that have not managed to clearly separate integration tasks from its day-to-day operations and has suffered from this.

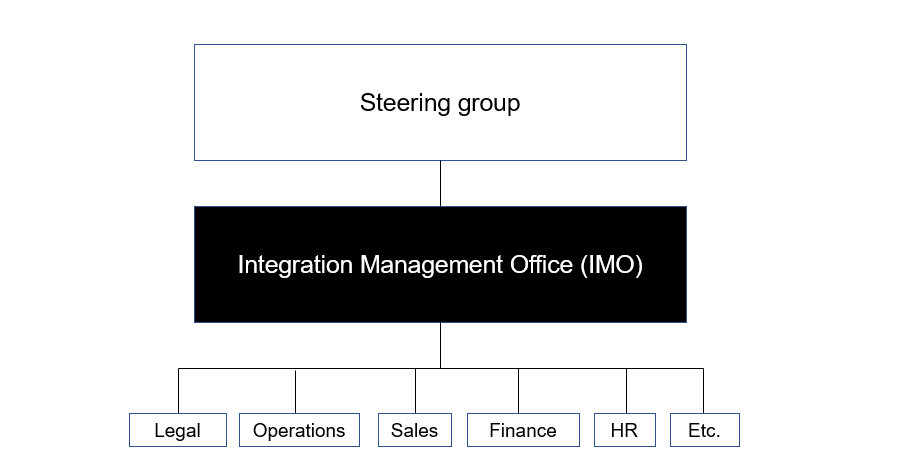

If there is no separation between the integration stream and daily operations, then management will constantly have to prioritize between long-term integration work and often more urgent operational tasks. In such priorities, the long-term efforts will often suffer. Companies that excel at PMI are characterized by delegating dedicated resources to manage such work streams. Figure 2 sets out an example of how this can be organized.

Communication

Competitors know that an acquisition occupies many resources. Consequently, they can use this opportunity to steal top sales people and customers. Particularly larger acquisitions usually leads to large changes in the company’s organization. This again can lead employees to worry about their job security. A well-developed communication strategy can mitigate adverse influences by reducing uncertainty in the organization.

This is accomplished by frequent and consistent communication. The relayed announcements should reflect the underlying deal strategy and form the basis for the corporate culture you want to achieve in the merged business.

Quick wins

Enthusiasm surrounding a transaction tends to fade away rapidly. This can often evaporate faster than it takes to implement necessary changes. Therefore, one should utilize the early phase, during which the enthusiasm is the greatest; to make the larger changes needed to achieve the desired organization structure and culture.

Lower hanging fruits should be picked at once to keep motivation within the organization. In particular within the sales teams it is vital keep momentum since these are the company’s public face.

People and culture

The value in most transactions relate to its employees. After the announcement of the transaction, uncertainty can arise. This in turn could put the organization at risk of losing key personnel and motivational drop. It is critical to identify key personnel quickly. Dialogue with these should start as soon as possible and e.g. incentive programs connected to reaching certain key performance indicators should be put in place.

Cultural integration is challenging, but a transaction can also act as a catalyst to produce positive changes and increase the motivation within the organization.

Best practice

Mutual implementation of best practice work processes is a key objective of many acquisitions. Work processes in both companies are mapped, before proceeding to standardize around best practice. Challenges related to this is twofold; partly it takes a long time to map and identify best practice, and in part because there will always be resistance against a change of routines. In order to succeed with simplifications and improvements, it is appropriate to involve the organizations so that new best practice solutions gets support from middle managers and other employees.

IT

Selection of IT systems can be critical to many organizations. When two companies merge, it is not always, so that its IT platforms are fully compatible. Because adaptations usually are necessary and such investments can be significant, it is critical to make thorough assessments of what options are available.

In short, it involves identifying companies’ IT processes and systems and then analysing the potential for combinations from a cost/benefit angle. Ultimately arriving at a definition of a future common IT platform and an agenda to achieve it.

Adaptations along the way

The integration plan should continuously be monitored and adjusted along the way. If new and significant information emerges, which differs materially from the existing business plan, one must analyse the variances, reformulate objectives and anchor the revised plan.

This article is by no means exhaustive. PMI involves critical, complex and dynamic processes. Therefore, considerable efforts must be devoted to developing a customized integration plan.

Our approach

Integration work combined with day-to-day operations can be challenging.

Since very few organizations do acquisitions on a regular basis, knowledge about such processes can also often be limited.

Mimir Consulting can assist in the PMI work by assuming different roles.

- Sparring partner for steering group

- Assisting or lead IMO

- Assist or lead sub departments when executing integration plans, e.g. finance department